Rethinking Quarterly Tax Payments: How Investors Are Using Brightwell to Build Wealth and Create Impact

Join Brightwell CEO Tony Capucille and Director of Advocacy Nate Bauer as they unpack how impact investors fuel real projects that benefit nonprofits while delivering meaningful financial outcomes.

Key Takeaways: Quarterly tax payments represent one of the largest recurring expenses for many accredited investors — yet they typically generate zero return and offer no control. Brightwell reframes this obligation as an investment opportunity by allowing investors to redirect a portion of their quarterly tax payments into solar projects that generate income, tax advantages, and measurable community impact. This strategic timing unlocks agency, improves financial outcomes, and transforms tax dollars into lasting legacy investments.

Rethinking the Quarterly Tax Cycle

For many accredited investors, quarterly tax payments feel like a constant drain. If you are a business owner, physician, partner in a professional firm, high-income W-2 earner, or someone with meaningful passive income, you are likely required to make estimated payments on April 15, June 15, September 15, and January 15.

These payments are driven by the IRS safe harbor rule — typically 90% of your current-year tax liability or 100% of your prior year’s liability (110% if your AGI exceeds $150,000). While most people confront their tax burden once a year in April or October, quarterly filers feel it over and over again. Four times a year, you write a check that produces no income, no wealth-building, and no community value.At Brightwell, we help investors rethink those payments through a simple question:

What if these required dollars could accomplish something meaningful?

How One Quarterly Payment Sparked a New Investment Strategy

Early in Brightwell’s journey, we met a California physician preparing to send a $2 million check tothe IRS. His practice thrived, and his real estate portfolio generated strong passive income. But like many high earners, he was frustrated by how much of his success disappeared into taxes — with nothing to show for it.

When he learned about Brightwell’s model, a different path became clear.

We presented a $1.6 million solar project that aligned with his values. By investing $1.1 million into the project just before his quarterly deadline, he captured enough tax benefits to reduce the $2 million he owed. Instead of sending all $2 million to the federal government, he invested $1.1 million, paid the remaining $900,000 to satisfy the IRS, and positioned himself for long-term income and impact.

He could have financed the remaining portion of the project but chose to complete the investment with cash.

Why This Matters for Investors

Two meaningful outcomes emerged from that decision.

1. He gained control — agency over tax dollars previously lost.

Rather than sending $1.1 million to the IRS with no return, he redirected those funds into a solar project that now produces recurring income, depreciation benefits, and durable financial value.

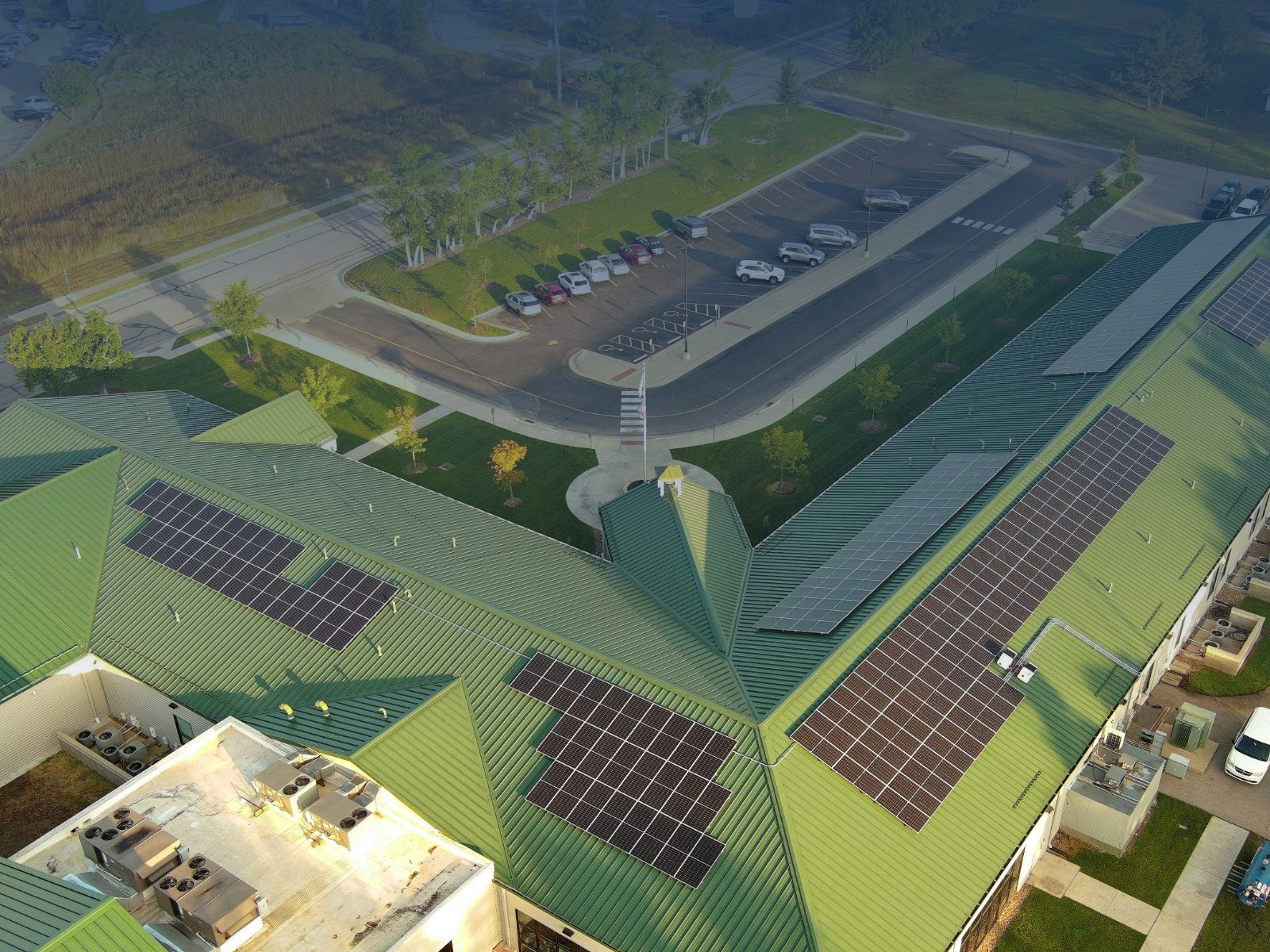

2. His investment produced measurable community impact.

The project he chose powered a regional food bank. Over the next 20 years, the food bank will save enough on its energy bill to provide an estimated 40 million additional meals. His tax obligation became something more than compliance — it became a multidecade contribution to community well-being.

That is the power of aligning required payments with values-driven investing.

How the Quarterly Payment Strategy Works

The process is straightforward:

- Estimate your annual tax liability using projected income and the IRS safe harbor method.

- Select a Brightwell solar project scheduled for installation within that same tax year .

- Fund the project with dollars you were already planning to send to the IRS.

- Receive the Investment Tax Credit (ITC) and bonus depreciation, reducing the amount you owe.

- Use the tax benefits to offset your quarterly payment, turning a sunk cost into an income-producing asset.

Your tax dollars now generate returns — instead of disappearing.

Timing Matters More Than Most Investors Realize

We encourage investors to start the process early in the year, ideally in January or February. This allows you to

- Skip the April 15 quarterly payment

- Gain access to the best selection of projects

- Confirm installation timing for 2026

- Align financing decisions with your annual tax plan

Our mission is simple:

Help you stop writing checks to the IRS and start investing those same dollars into assets that create financial return and community impact.

Once you experience this strategy, quarterly tax payments become something entirely different — an opportunity rather than an obligation.

Ready to get started? Contact our team to get started.

—

FAQ

Who qualifies for this quarterly payment strategy?

Accredited investors who make large quarterly tax payments — typically due to self-employment or passive income — are strong candidates. If you expect to owe more than $250,000 in federal taxes annually, this strategy is designed for you.

Is it legal to redirect IRS payments into solar projects?

Yes. This model is built entirely on the federal Investment Tax Credit (ITC) and bonus depreciation rules under Section 48 of the IRS code. If your project is installed within the same tax year, these credits can offset tax liability and reduce the amount you owe.

When should I get started?

The best time is Q1, before your April 15 payment. Starting early ensures you have time to review projects, confirm installation timing, and redirect up to 100% of your four quarterly payments into income-generating assets.

Perspectives on modern operations and smart growth.

Running on Empty: Addressing the Energy Shortage in America by Refueling the Non-Profit Sector

America is running short on energy capacity just as nonprofits are being stretched by rising utility costs. This piece examines how those two challenges can be addressed together through a new investment-driven approach that strengthens the grid while lowering operating expenses for the organizations that serve our communities.

Navigating FEOC: Understanding the Impacts on Solar Projects

The renewable energy landscape has entered a new phase of complexity. With the expansion of Foreign Entity of Concern (FEOC) rules and new IRS guidance issued in early 2026, investors and project stakeholders must now navigate a more detailed compliance framework when pursuing solar tax credit strategies.

Let’s chat to see how we can unlock new opportunities for impact, together.